podcast AI & ML

Generative AI in the Real World: Understanding A2A with Heiko Hotz and Sokratis Kartakis

article AI & ML

We Are Only Beginning to Understand How to Use AI

Lessons from Google Docs and Other Internet Innovations

article AI & ML

From Automation to Insight

Using AI to Keep Up with Our Authors

article

One Year Later: What Can AI Learn from Accounting Standards?

video

Build Your KPIs Around the Golden Rule—Arvind Narayanan Live with Tim O'Reilly

article

Why AI-Driven Client Apps Don’t Understand Your API

article

Is AI a “Normal Technology”?

video

The Skill Kids Need to Learn in the Age of AI—Arvind Narayanan Live with Tim O'Reilly

article

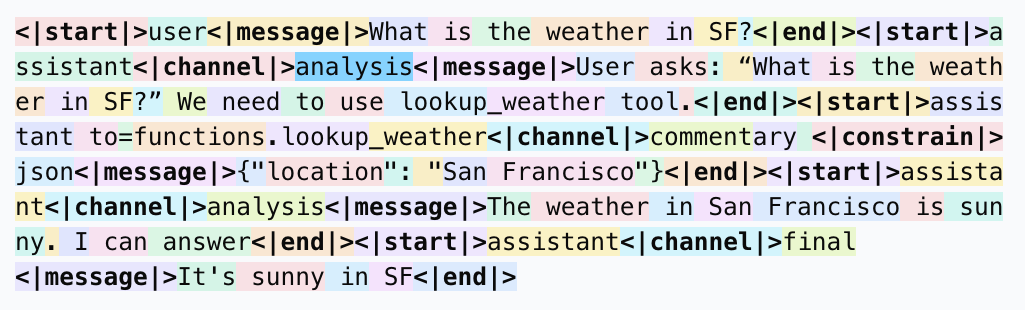

Context Engineering: Bringing Engineering Discipline to Prompts—Part 2

article

Chat Templates

article

People Work in Teams, AI Assistants in Silos

article

Taming the Delightful Chaos

article

The Abstractions, They Are A-Changing

article

AI’s Swiss Cheese

article

Context Engineering: Bringing Engineering Discipline to Prompts—Part 1

podcast

Generative AI in the Real World: Jay Alammar on Building AI for the Enterprise

0:00

/

0:00

article

The Future of Product Management Is AI-Native

video

Should Product Managers Use AI to Build Prototypes?—Marily Nika Live with Tim O'Reilly

article